The Facts About Clark Wealth Partners Uncovered

Table of ContentsThe Greatest Guide To Clark Wealth PartnersNot known Facts About Clark Wealth PartnersClark Wealth Partners for BeginnersThe Definitive Guide for Clark Wealth PartnersSome Known Details About Clark Wealth Partners Clark Wealth Partners for BeginnersEverything about Clark Wealth PartnersSome Ideas on Clark Wealth Partners You Need To Know

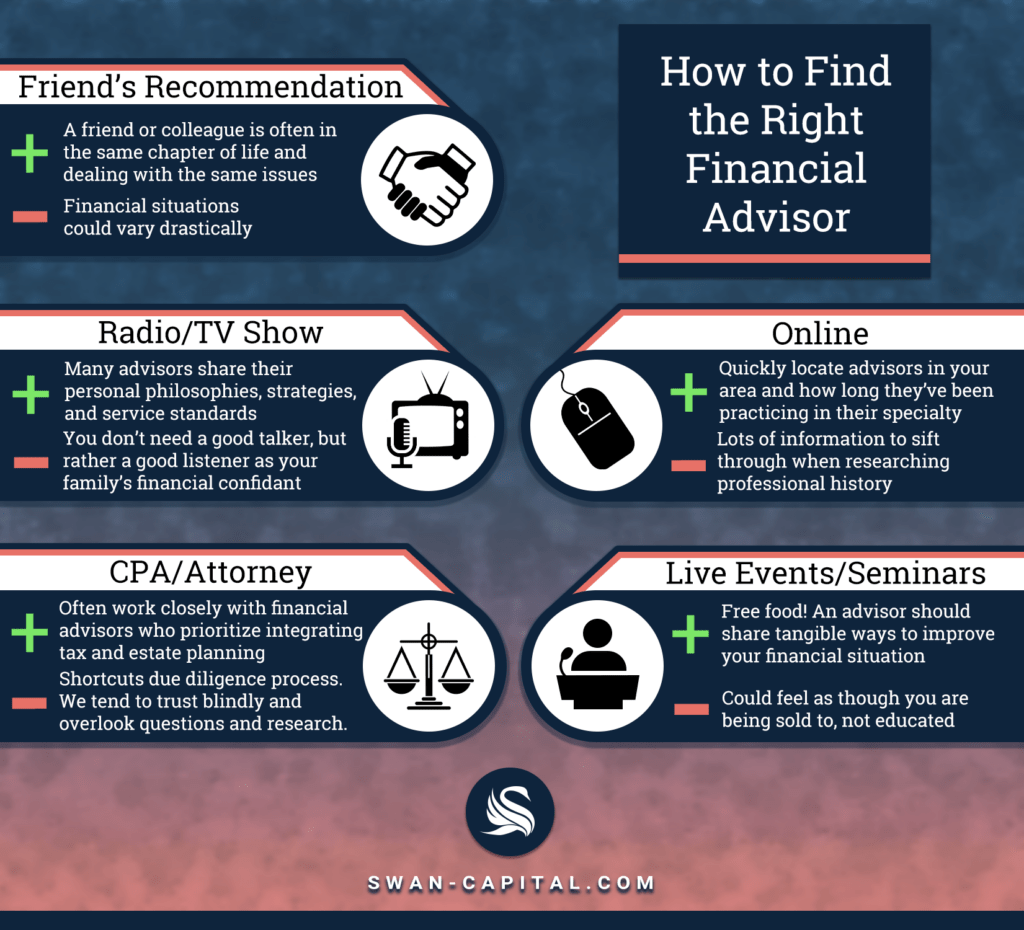

Common factors to think about a financial consultant are: If your economic scenario has ended up being much more intricate, or you do not have confidence in your money-managing abilities. Conserving or browsing significant life occasions like marital relationship, separation, children, inheritance, or task change that may substantially affect your financial situation. Navigating the change from saving for retirement to protecting wide range during retired life and how to develop a solid retired life earnings plan.New technology has led to more comprehensive automated financial devices, like robo-advisors. It's up to you to investigate and figure out the appropriate fit - https://clrkwlthprtnr.wordpress.com/2025/11/26/why-choosing-the-right-financial-advisors-illinois-matters-for-your-financial-future/. Eventually, a good monetary consultant needs to be as conscious of your investments as they are with their own, preventing excessive charges, saving cash on tax obligations, and being as clear as possible concerning your gains and losses

Rumored Buzz on Clark Wealth Partners

Making a payment on item suggestions doesn't always mean your fee-based expert functions against your finest passions. But they may be a lot more likely to recommend services and products on which they make a commission, which might or may not remain in your best passion. A fiduciary is legitimately bound to place their customer's passions initially.

This common enables them to make suggestions for investments and services as long as they suit their customer's goals, risk tolerance, and financial scenario. On the various other hand, fiduciary consultants are legally bound to act in their client's best passion instead than their very own.

The Buzz on Clark Wealth Partners

ExperienceTessa reported on all things investing deep-diving into complicated monetary topics, clarifying lesser-known financial investment opportunities, and discovering means viewers can work the system to their advantage. As a personal money professional in her 20s, Tessa is really familiar with the influences time and uncertainty carry your investment decisions.

It was a targeted promotion, and it worked. Read a lot more Read less.

Clark Wealth Partners Things To Know Before You Buy

There's no solitary route to ending up being one, with some individuals beginning in banking or insurance coverage, while others begin in accounting. A four-year level gives a solid foundation for careers in investments, budgeting, and client services.

8 Easy Facts About Clark Wealth Partners Shown

Typical examples include the FINRA Series 7 and Series 65 tests for protections, or a state-issued insurance coverage permit for marketing life or wellness insurance. While credentials might not be legitimately required for all planning functions, employers and customers frequently see them as a benchmark of professionalism and reliability. We look at optional credentials in the following section.

A lot of economic planners have 1-3 years of experience and experience with monetary items, conformity requirements, and direct customer interaction. A solid instructional history is vital, however experience shows the capacity to apply theory in real-world setups. Some programs incorporate both, permitting you to complete coursework while making supervised hours via teaching fellowships and practicums.

9 Simple Techniques For Clark Wealth Partners

Numerous get in the area after operating in banking, bookkeeping, or insurance policy, and the shift needs persistence, networking, and frequently sophisticated credentials. Very early years can bring lengthy hours, pressure to develop a customer base, and the demand to continually prove your experience. Still, the job offers solid long-lasting possibility. Financial organizers appreciate the possibility to work very closely with customers, overview crucial life decisions, and typically achieve adaptability in routines or self-employment.

Wide range managers can enhance their revenues useful content through compensations, property fees, and efficiency bonuses. Monetary managers manage a team of financial coordinators and advisers, setting departmental approach, taking care of compliance, budgeting, and routing interior procedures. They invested much less time on the client-facing side of the sector. Almost all monetary supervisors hold a bachelor's degree, and lots of have an MBA or similar academic degree.

An Unbiased View of Clark Wealth Partners

Optional accreditations, such as the CFP, normally call for added coursework and testing, which can expand the timeline by a couple of years. According to the Bureau of Labor Statistics, individual monetary experts earn a median annual yearly wage of $102,140, with leading income earners making over $239,000.

In various other districts, there are regulations that require them to fulfill certain demands to utilize the monetary consultant or financial organizer titles (financial advisors Ofallon illinois). What establishes some monetary consultants besides others are education and learning, training, experience and qualifications. There are numerous classifications for economic consultants. For financial planners, there are 3 typical designations: Licensed, Personal and Registered Financial Planner.

Not known Facts About Clark Wealth Partners

Those on wage may have an incentive to promote the items and solutions their employers supply. Where to locate an economic advisor will depend on the type of guidance you require. These organizations have staff that might aid you recognize and purchase particular kinds of investments. Term down payments, guaranteed investment certificates (GICs) and mutual funds.